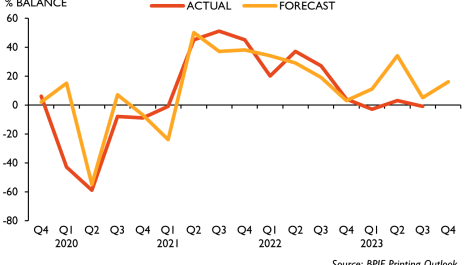

The latest Printing Outlook survey from the BPIF suggests that print industry performance was down in the final quarter of 2022 compared to the previous one but still recorded a net positive balance between companies whose output expanded and those for whom it contracted.

Conforming closely to the previous forecast, the top line figures show that one third (33%) of printers increased output in the quarter, with 29% seeing it decrease and the balance holding steady, despite economic and political uncertainty, energy price rises and general inflation. The figures mark the seventh consecutive quarter of growth but the BPIF notes that this is getting harder to maintain as the Covid-related decline of 2020 moves further into the past, and this is reflected in a net negative figure for business confidence for the first time in two years.

However, a slightly more positive output balance is expected for Q1 2023, with 35% predicting growth in output and 24% expecting a drop and the balance of 41% staying the same. There is an expectation that cost inflation may have peaked, offset by uncertainty over continuing government help with energy costs.

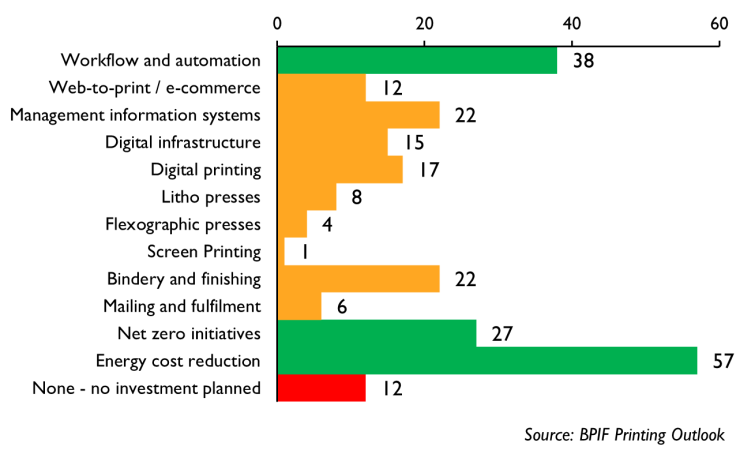

In light of this, it is not surprising that the top three investment targets for the coming year were energy cost reduction (57%) with workflow and automation coming next at 38% and, encouragingly, net zero initiatives for 27%. MIS and bindery and finishing both came next at 22%, with around one in eight (12%) having no investments planned. Finance costs and late payment are also surging concerns, with the latter running at the highest level on record.

BPIF Economist Kyle Jardine commented, ‘The UK printing industry is continuing to recover but it is not finding it easy to maintain this recovery. The wider economic landscape has dented industry confidence, and growing industry turnover statistics mask the challenges in a way that paper, board, and ink consumption statistics do not.

‘Companies are adapting, and many are still looking to grow. The full report shows that investment budgets and priorities for many companies have been re-evaluated in the wake of the current cost crisis – difficulties in recruiting labour have focused investment towards automation and workflow efficiencies, and high energy costs have made net zero and energy efficiencies a much more popular target.’