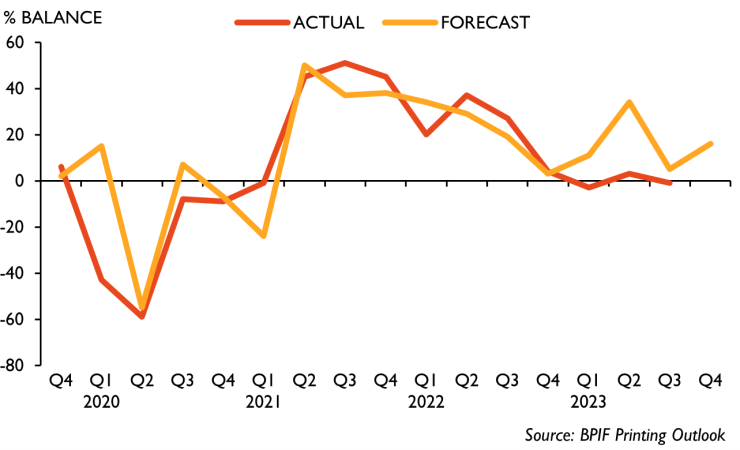

The UK’s printing and printed packaging industry struggled with its performance in the third quarter of 2023, at least as far as output and orders are concerned, but expectations are more positive for Q4, according to the BPIF’s most recent Printing Outlook survey.

The BPIF notes that forecast for Q3 was for some output growth to return; that expectation has turned out to be overly optimistic as more of the polled companies experienced a decline in output than an increase during the period.

Factors prevalent in the previous quarter, namely a fragile economy, lingering concerns over inflation for both consumers and businesses, and the possibility of further interest rate increases, have persisted. Printers continue to concentrate on controlling costs, increasing productivity and looking for new sales opportunities. Some cost pressures have eased, however, and are expected to ease further, but lower prices yet may be required to encourage more output and order growth in Q4.

The survey revealed that one-third (33%) of printers managed to increase their output levels in the third quarter of 2023, whilst another third was able to hold output steady, leaving 34% experiencing a decline in output. The resulting balance was therefore -1, below the +5 that had been forecast, and a little worse than the +3 experienced in Q2.

More positively, forecasts for Q4 are for an improvement in output growth, though it may be more of a case of fewer companies experiencing declining growth rather than a significant seasonal boost. Output growth is forecast to increase for 36% of companies, with 44% predicting steady levels in Q4, yielding a balance forecast of +16 for the quarter. Top business concerns now are led by sales levels, closely followed by competitor pricing and ongoing wage pressures.

BPIF chief executive Charles Jarrold commented, ‘It has been a challenging year so far, but it is pleasing to see an uplift in confidence and expectations for the final quarter, even if it’s not quite in line with what might be considered a normal seasonal boost.

‘The survey newly reports on uncertainty levels; thankfully they are now expected to stabilise and, with more than three-fifths of the industry with an excellent, or good, cash flow position, there is well-founded hope for the period ahead.’

The report also now queries sustainability efforts and notes that more than half of respondents are measuring their carbon emissions