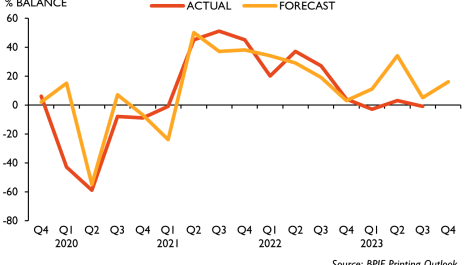

The BPIF has published its latest Printing Outlook report indicating that the UK’s printing industry is moving closer to its pre-Covid levels. The organisation reports that a majority of companies within the sector improved their performance in Q3 of this year and many expect to see further improvements in Q4.

There was plenty of positive news in the report, including improved confidence in the general state of trade, increasing capacity utilisation and a fall in the number of printing and packaging companies experiencing critical financial distress.

Furthermore, even with the furlough scheme having come to an end, 91% of companies reported that they do not expect to make any redundancies before the end of December.

There were of course issues raised, with substrate cost the top business concern for printing companies, for the second successive quarter. A shortage of raw materials was highlighted as the most challenging issue affecting companies’ ability to recover from the impact of the pandemic.

The report also indicated that the UK economy, and the printing industry, is moving past Brexit, but there are still companies dealing with the adverse effects of Britain leaving the European Union, including over supplies, barriers and costs.

BPIF Economist Kyle Jardine commented on the report, ‘It is great to see that much of the industry has experienced healthy growth in Q3 and are feeling positive about activity levels in Q4. However, some sectors and many companies are not yet back to what they would consider to be ‘normal’ activity levels.

‘Unfortunately, there are some clouds hanging over further recovery, particularly the supply chain constraints that are limiting stronger growth. Input price inflation has been a mounting concern in recent times – prices have increased before, but it is the pace and frequency of current increases that is currently troubling the industry. Printing Outlook has never reported on a period of such one-sided price movements across all cost areas before. But it’s not just the cost of inputs – supply shortages are biting and frustrating a full recovery for some companies that have strong demand levels.’

Chief executive Charles Jarrold added, ‘Access to skilled and unskilled labour is a major concern and a contributing factor to production constraints. We’ve seen a strong increase in the take up of Apprenticeship Training, which is really encouraging, reflecting not only the current challenges of the market, but also a marked increase in business activity levels as the pandemic recedes. This apprenticeship training is supporting business needs ranging across both technical print roles, and the higher-level leadership and management development. We do however acknowledge that this is not a short-term fix, and we continue to represent industry challenges to Government and lobby for improved access to labour and support for skills development.’