For several years textiles has been considered a huge growth area for digital print. Trends in décor and fashion markets, as well as the on-demand and personalisation advantages offered by digital, have been combining to great effect. Then came the coronavirus. What impact will the pandemic have on this burgeoning sector? Charlie Kortens spoke to some of the companies that have been pioneering digital textile printing to find out

Just as digital has expanded to seize an ever greater share of the overall print market, so it is building more and more of a presence in the textiles world. Clothing, décor, soft signage and other areas have all started to grasp the opportunities digital printing has to offer and it seems that the current crisis won’t have too much of an impact on that trend…

Growth

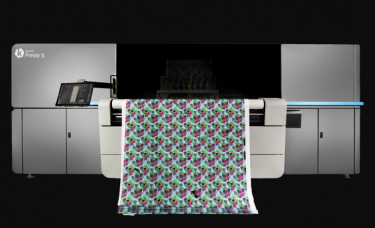

‘The digitally printed textiles market is experiencing double-digit annual growth worldwide, forecast to reach $5.5 billion by 2023, according to research by Smithers Pira,’ says Michael Lewis, HP’s channel manager in large format production. ‘In the UK, we’re seeing similar upwards movement in the market and a real buzz around digital textile printing. We’ve seen it at tradeshows since we first launched the HP Stitch S Series in 2018 at Fespa, and in the growing customer demand for bespoke, short-run textiles printing.’

Sharon Donovich, product marketing manager at Kornit, agrees,‘With the growing trends of online shopping, sustainability, local production and customisation, as well as the fact that the digital textile printing is technologically advanced and offers faster, better and lower cost prints, digital print’s big growth area over the next few years will definitely be in the textile area.’

EFI’s chief revenue officer Frank Mallozzi added, ‘Digital print has remarkable growth prospects in several market areas. Certainly textiles will be one of the fastest in terms of growth rate. Many textile producers are transitioning to digital, including EFI Reggiani customers who started using our analogue rotary product but have determined that digital, with the efficiencies and productivity we can provide, is the future. The ecosystem we have built around digital for those customers is key to making a stronger transition to digital and breakthrough solutions, such as the EFI Reggiani BOLT single-pass printer – the fastest digital textile printer on the market – that will help accelerate even more digital conversion.’

EFI insists that fast fashion is set to be another big consumer trend leading to increased digital textile printing

Trends

If the pandemic doesn’t impact on the growth of digital textile printing, so much the better, but will it alter specific market trends? When asked how she thought things might be affected, Ms Donovich said, ‘It seems that the current crisis will accelerate the change in consumer behavior and the trends that started before the pandemic will grow and will influence the textile industry faster.

‘Online shopping enables shoppers to conveniently compare the prices of industry products. Manufacturers are increasingly turning to online to reach end consumers more effectively. In addition, consumers are now seeking new and creative ways to express their identities, clothing is the most popular one through unique, customised or personalised impressions, styles, and messages. For example 74% of Millennials and Generation Z are interested in buying products that are personalised to their taste/made specifically for them. Consumers are willing to pay 20% more for a personalised product.’

Mr Mallozi added, ‘The crisis could accelerate some existing trends. Of course, it is important to note how the pandemic has changed how people buy products. Aside from the growth of online shopping, in-person retail has changed dramatically and EFI customers are on the front lines with the transition.’

Customisation is another area growing strong, as Mr Mallozzi points out, ‘Well before the crisis, and certainly more now than ever, consumer goods marketers realised the potential for greater customisation, versioning and multi-SKU marketing to grow sales – all of which demands more frequent artwork changes that fit the digital print value proposition. Another big consumer trend leading to digital print in textile, fast fashion, is not necessarily related to the crisis, but will continue to grow. It reflects overall initiatives to streamline supply chains and reduce the time needed to launch new designs. Our digital EFI Reggiani digital printers perfectly suited to this trend, and it is why many leading fashion brands – including the household names in fast fashion – rely on them for production.’

Mr Lewis said that one of the biggest changes might be an increase in companies returning production to Europe, explaining, ‘We’re observing more and more manufacturers relocating printing locally, thanks to digital print. The flexibility it lends means that manufacturers are no longer confined to placing huge minimum order volumes from overseas. We’ve seen a lot of textile manufacturing migrating back to the UK.

‘According to the 2019 Allied Research Report, the UK is the 15th largest textiles manufacturer in the world, with the value of production growing since 2009, and export growth across most areas of apparel since 1990. The total production value of UK textiles is worth just under £9 billion and growing, while the global apparel market alone has a total value of just under £1.3 trillion (2014).’

Kornit’s 10-channel Presto textile printer is just one option in its portfolio

Kornit’s Ms Donovich agreed with that assessment, saying, ‘Reshoring/onshoring/local production, whatever you name it, it will be accelerated and enable lean manufacturing, just in time with no need to hold or produce large and unnecessary quantities of huge inventory. It will allow fast response to online shopping, will enable the production of customised on demand products and bring back jobs to Europe and North America.’

For his part Mr Mallozzi expressed far more caution, explaining that though this trend might be possible in Europe, ‘China in particular has capabilities to remain a giant in global manufacturing. Plus, with digital textile printing in particular, there are other forces at play that should continue to drive growth in China and across Asia – including a need to replace analogue textile processes, which are a major source of pollution, to more-sustainable methods.’

Future plans

So, despite the pandemic, the accompanying lockdowns and the inevitable economic impact, things still look bright for digital textile printing. What, therefore, are companies doing in order to make sure they are part of this growth area?

‘Kornit solutions is focused on the transformation of the textile market,’ Ms Donovich explained. ‘Every year we bring faster systems, lower COO and lower CPP, improved print quality, better and softer hand feel to answer the fashion market needs, production monitoring tools and connectivity to the most advanced tools to enable micro factory and efficient production. Kornit Digital believes that as things stabilise, the textile industry will have an increased urgency to accelerate the shift to proximity and on-demand digital textile production, and we are ideally positioned to execute on this need.’

Mr Mallozzi went so far as to suggest that the pandemic could actually come with some silver linings for textiles. ‘There is another growth market directly related to the pandemic,’ he explained. ‘Divisional graphics has become important; nearly every retail location, office or other place where groups of people congregate needs barriers and digital printing graphics or messages for those barriers is a growing opportunity. EFI customers are also creating distancing graphics – for example, floor decals showing consumers where to stand in queue to maintain social distance. Many EFI customers are doing work in these two areas, and many of our textile customers are also producing masks and face coverings. While these markets do not replace the overall print volume from traditional display graphics, these types of applications may be mainstays for printing companies well into the future.’

Mr Lewis agreed, explaining, ‘If history teaches us anything, it is that crisis brings opportunity, print service providers will be looking for new solutions to help adapt to new ways of working or move into new sectors. We made our PrintOS Marketplace applications free of charge until August to help our customers better manage their businesses during this time. This is only one of the many ways we believe we can help our customers, both during this difficult time and through the recovery period that will follow.’

‘Many of our print service providers are working with limited staff to adhere to health regulations, while retooling production lines to support the effort. Carly Press in Wellington, Somerset identified the need to print free stickers for local residents to put up outside their homes, in order to indicate they are in self isolation. Utilising their HP Latex 360 printer and some spare press capacity, Carly Press was able to print clear, bright stickers, and is experiencing growing demand for from their local area to nationally across the UK.

‘Prime Group’s managing director Jon Tolley, based in Nottingham, UK and married to a critical care practitioner in Intensive Care, switched his expertise in laser-cutting and plastics to making prototype visors and has already shared the design specifications with Italian print specialists Pixart. Prime can already make thousands of visors every day and are hoping to ramp this to 10,000 per day.’