Wirralco has diversified into non-standard items such as small packaging

Whatever travails the rest of the sector may face, trade printing seems to be an area that remains buoyant, innovative and ambitious in the scale of its investment, reports Andy Knaggs.

Trade print operators are continually looking to evolve their service offering, and assessing where and how they can improve their levels of customer service. This, at least, would appear to be the case, based on responses to a survey of trade printers carried out by Digital Printer.

At the upper end of the scale is Onlineprinters, for example, which has made huge investments in new equipment this year, more than €5 million worth in fact, including an HP Indigo 12000, an additional Heidelberg Speedmaster 8-colour-press, and further investments in finishing kit from Müller Martini.

While the vast majority of Onlineprinters’ capacity is in Germany (well over one hundred litho units), it has invested in the UK market through its acquisition of Southend-on-Sea-based Solopress, and here there has been further investment in new and bigger premises, and additional CTP capacity to keep up with demand.

Onlineprinters’ Patrick Piecha: creating many chances

The development of product options across the group has continued in line with this capital expenditure. Onlineprinters’ head of press and public relations Patrick Piecha says: ‘One of our goals is accelerating production for as many products as possible. In 2017, we launched the same-day-option for brochures and many other products.

‘For more customer convenience, we implemented a “repeat-order-button”. An order can now be “repeated” without a new upload of the print data, even from a mobile device.

‘The year 2017 has brought more than one hundred new products for our customers, all intended for a one-stop shopping experience. One of our highlights was a new premium paper collection made by Gmund. The “Onlineprinters Art Classics” collection comprises four new types of paper, which are only available from Onlineprinters.’

Lean in London

Gary Peeling’s WhereTheTradeBuys operation has also moved into a new facility in East London (a 55,000 sq ft site costing £1.5 million), with the intention of extending and improving its online services. Mr Peeling explains, ‘This is a carefully planned lean, automated manufacturing environment with the capacity to future proof output for online orders, which is our fastest growing business unit.’

WhereTheTradeBuys’ Gary Peeling: automation, not undercutting, is bringing prices down

A new 8-colour Ryobi LED UV press and digital envelope printing were added to the plant and the capacity of the bindery was increased by 100% with new PUR binding lines and two new high-volume trimming lines.

For the ongoing development of the business, these investments will mean the provision of Amazon Prime-style same-day print services into London, and next day anywhere in the UK. It will allow WhereTheTradeBuys to extend and improve its book-on-demand, short run envelope and offset printing services. Next year, the firm is to explore an online service for direct mail.

A number of other UK trade printers have reported significant investments in kit this year: Quinns the Printers, for example, has established a new factory and invested in the UK’s first Heidelberg XL 106-8 LE-UV press plus more finishing kit. Its click-and-collect service for the UK and Ireland is growing quickly, while its Quinnsessential range offers “super-fast” turnaround on business cards and flyers.

TradeDigitalPrint.co.uk, which is owned by Northside Graphics, has spent around £1 million in the last 12 months on two HP Indigo 7r presses and on beefing up its finishing side with Duplo and Morgana machines. It has also invested in website development and bricks and mortar – a new mezzanine to increase production and office space. All of this has been driven by the simple need to meet growing demand for its products, rather than introducing new products to the market.

Wirralco has introduced new products however, with the arrival of digital foiling and taping machines helping it to deliver a short-run packaging service which has been particularly well received in the promotional gifts market. ‘That is a new sector for us and has opened up some great new opportunities,’ says sales and marketing director Lesley Graham.

The print gig

All of these companies are experiencing increasing demand for their products, and there seem to be some interesting movements in terms of their customer base. In particular, a number of print companies are ditching production to concentrate on print re-selling.

‘Many of our customers are printers and some now have abandoned using their own equipment, instead relying on partners to deliver services – it’s the print equivalent of the “Gig Economy”,’ says Gary Peeling.

Other trade printers report very similar experiences. ‘We do believe that print reselling as a whole is increasing,’ observes Gary White, managing director of TradeDigitalPrint.co.uk. ‘Why not have your digital printing printed on an HP Indigo without any capital investment?’

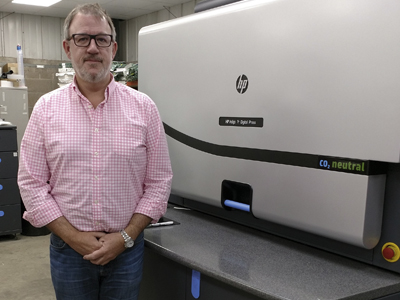

Gary White of TradeDigitalPrint: ‘why not have your digital printing on an HP Indigo without any cpaital investment?’

Print resellers such as designers, agencies, office supplies and print management firms are also being joined with increasing interest from the New Media sector, says Mr Peeling, where designers are more comfortable ordering print online. According to Patrick Piecha of Onlineprinters, the ease of online ordering is being embraced by commercial printers for a wide range of standardised products, leaving them now to focus often on local services and/or specialisation, while buying standardised products from online print shops.

Mutual benefit?

It would perhaps be easy to imagine that every part of the dynamic that exists between trade printing and commercial printing is regarded as mutually beneficial; that top-notch equipment, highly developed online functionality, innovative new products and outstanding customer service, all combine to make everyone’s world a little easier. That would be to ignore the historic tensions between trade and non-trade print suppliers, exacerbated by newer concerns about the online world replacing existing ways of working. The most recent BPIF Printing Outlook (Q3 2017), after all, cited ‘competitors pricing below cost’ as the biggest concern for printers.

Putting these issues to trade printers and asking them about the perceptions of trade printers that they encounter gave rise to a number of interesting perspectives. Gary White of TradeDigitalPrint.co.uk gets right to the nub of the matter: ‘I think the problem that non-trade printers have with online trade printers is that they don’t trust us because we “sell to anyone”. For us, this is simply not the case and nor will it be. We have two sites aimed at completely different markets with two completely different pricing structures.’

The response of Quinns the Printers’ Peter Bradley is a bullish one: ‘I don’t give this a second thought. More and more printers are dipping into our market, so it can’t be that bad. I guess as Mahatma Gandhi said, “first they ignore you, then they laugh at you, then they fight you, then you win”.’

In tackling the view that competition between large trade printers has driven prices and margins down across the industry, Lesley Graham of Wirralco draws a distinction between trade operations such as her own and those of “online giants”.

‘The feedback we have received from our customers who have their own presses is that it has affected them as they cannot compete with the low prices online. It also affected our business and we now promote products that these online giants don’t produce or that don’t fit with their high capacity, hands-off workflow. For example, we offer a much wider range of dies for presentation folders so the customer is not limited to styles and size, etc. Having in-house die cutting has proved a benefit to our business, as we produce non-standard products which are difficult to source online.’

Those with ”high capacity, hands-off” workflows see it a little differently. Gary Peeling observes: ‘Automation, industrialisation and aggregation are reducing prices, not because margins are being reduced but simply because its more efficient to price, order and produce printing in these automated environments.

There’s more

‘Direct customers who are prepared to order online will have gone already; the reason they won’t all go online is that they get more from their print provider than just price, production and quality; they also get advice and guidance and that’s valuable and will be required long into the future.’

Patrick Piecha of Onlineprinters comes up against typical prejudices: that online destroys prices and destroys local traders. ‘The truth is, “online” has created many chances: the ganged run and the industrial printing process, in combination with an e-commerce business model, provides so many advantages: lower prices, more efficiency, and more environmental protection,’ he says.

Industrial printing has led to lower prices, he agrees, but this is due to better efficiency, and not through any kind of malicious price dumping. ‘We don’t see, and we are not interested in, a downward price spiral,’ he added.

There are other factors too: paper prices are also a big problem, according to Peter Bradley from Quinns, who says: ‘I would say the changing cost in raw material has affected the market more in 2017, whereas 2016 was all about pricing. There is still a bun-fight going on for sure, but we try to have better service and turnaround whilst still maintaining a good margin for our customers too. There are a few out there that priced themselves to gain market share. What they are going to do with it once they have it, I don’t know. It’s not all about scale.’

Read the full November issue of Digital Printer here. Subscribe to the magazine for free – register your details here.