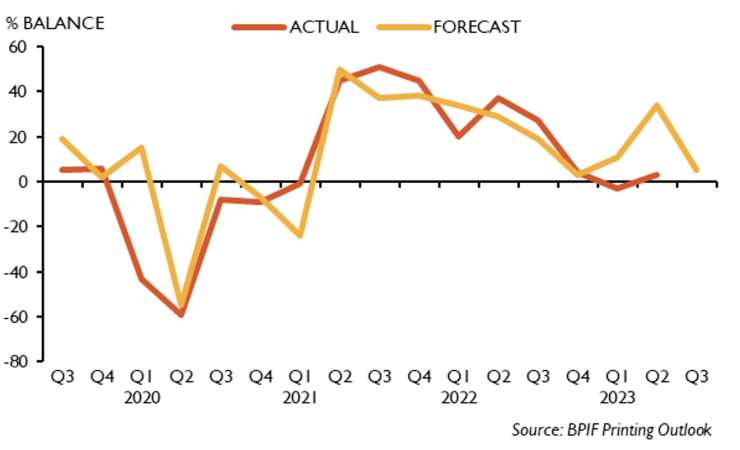

Challenges for the UK’s printing and printed packaging industry continued into the second quarter of 2023 as orders and output did not rebound following poor performances in the previous two quarters, according to the BPIF’s latest Printing Outlook survey.

The previous forecast was that Q2 would experience an upturn in industry performance, but this expectation has been thwarted following a fragile economic performance, prolonged concerns over inflation levels for both consumers and businesses, and the continued upward trajectory for interest rates, raised again on 3 August 2023 to levels not seen since 2008. According to the BPIF, printers are focussing on controlling costs, increasing productivity and managing sales more effectively. Cost pressures are easing but lower prices may be required to encourage output and orders to grow in Q3; pricing changes are a critical concern for many.

The survey found that three in 10 respondent printers were able to increase output levels during the quarter, while more than two-fifths (43%) held steady and 27% declined. The resulting +3 balance was well below the +34 anticipated at the end of Q1 but an improvement on the net -3 during that period.

Looking ahead, expectations for the coming period have been significantly lowered, in comparison to last quarter’s forecast, as the challenging climate extends into Q3. Output growth is forecast to increase for 32% of companies, 41% predict that they will be able to hold output levels steady and 27% expect output levels to fall. The resulting balance forecast is +5 for the volume of output in Q3. A fall in the inflation rate at the end of the Q2 period may help in the subsequent quarter.

The chief concern now is competitors pricing at or below cost, while energy cost has moved into second place, with sales levels in third place and wage pressures in fourth.

BPIF chief executive Charles Jarrold commented, ‘Unsurprisingly, a slowing economy has had its impact on the sector, being as it is a bellwether. We are seeing some signs that the higher interest rates are impacting not just on business but also in reducing inflation. Against an uncertain economic backdrop, the cashflow analysis in the full report shows that much of the industry is in a reasonably strong financial position, 87% have either an excellent, good, or normal cash flow position. However, there is still a realisation that companies need to pay close attention to this and devise and follow plans to improve their profitability. Controlling costs is key, the report highlights this and some other areas that companies are focussing on.’