Heidelberg has released its half-year figures as its sales climbed to €590 million in the second quarter versus the previous year’s figure of €542 million.

At €1120 million, sales for the first half-year are around 14% up on the previous year. The packaging segment enjoyed particularly strong growth, from €415 million in the previous year to €535 million.

Due to the higher sales, EBITDA improved to €68 million in the second quarter. This exceeded the previous year’s figure of €38 million, which was adjusted for non-recurring income. A better price quality of sales that countered the substantial increases in the costs of raw materials and intermediate products also contributed to the higher EBITDA, which reached €104 million for the half-year.

The net result after taxes after six months climbed from €13 million to €44 million, increasing from €27 million to €39 million in the second quarter. This exceeds the level for the whole of the previous year. In the second quarter, incoming orders continued to rise, to some €622 million (up 5%). The company states this was supported by currency effects, and by high demand from Central Europe and North America.

Half-year incoming orders reached a level of €1229 million, as a result of which the order backlog is above €1 billion for the first time in years. This backlog and the half-year figure bode well for the German manufacturer to achieve the targets for the year as a whole, though in the coming six months it expects further increases in personnel and energy costs. It was also noted that the company’s previously booming EV wallbox charger business has slowed.

CEO Dr Ludwin Monz said, ‘Despite a difficult environment, we have successfully overcome the challenges in the first half-year and achieved further growth. We remain cautious, though, because it’s not yet entirely clear how the global situation will develop. During the first half-year, Heidelberg has laid a good foundation for achieving our financial targets. With this in mind, we are focusing on maintaining our supply chains, safeguarding our margin through higher sales prices, and continuing our cost discipline.’

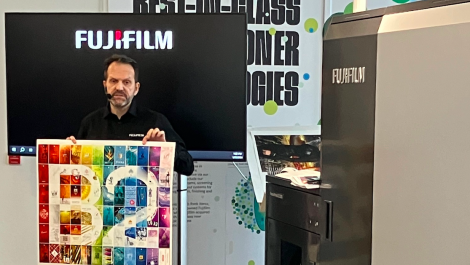

Meanwhile, Heidelberg UK has opened its new HQ Stockley Park business estate in Hayes, near Heathrow Airport, taking the entire 2000sqm ground floor of the Furzeground Way building. UK managing director Ryan Miles commented that the previous Brentford site, which had been occupied since Linotype days, has become ‘old, stale and disjointed’ and ‘needed refreshing’.

The new demo centre only houses the Versafire EV and EP sheet-fed toner digital presses, plus Prinect workflow and Heidelberg Assistant software, with offset press demonstrations conducted via live link to the Wiesloch, Germany factory. As well as back-office functions, the customer contact centre, remote support, spares and consumables ordering and management and customer training are run from the new site.

In presentations to trade press at an event on 8 November, head of software solutions Paul Chamberlain revealed that the Heidelberg Assistant live dashboard would be superseded next year by ‘H-Plus’, a more comprehensive cloud-based software offering that would also incorporate aspects of the Prinect workflow such as Print Shop Data Analytics. H-Plus is currently in beta testing at 30 sites around the world, four of which are in the UK. No specific launch date was given for H-Plus.

Developments in highly automated offset print were shown, suggesting that the run length boundary between offset and digital is being pushed down, with fully automated plate loading, blanket washing and set-up enabling 17 500-off jobs to be handled in an hour on a B1 long perfector press capable of 18,000sph. Heidelberg’s calculations suggest that the cross-over point might be as low as 150 sheets or less and Heidelberg expects this type of capability to appeal to busy web-to-print sites. From an environmental perspective, although wastage is reduced to well below previous offset levels at around 100 sheets instead of 500 (versus none with digital), there are still the material and energy costs of platemaking and disposal.