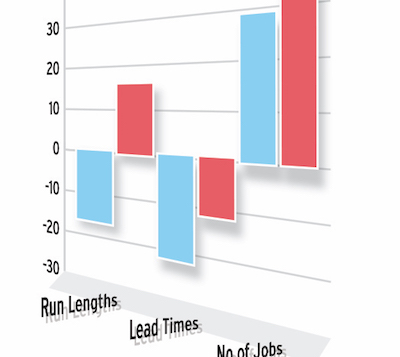

The report examines a number of aspects of the job mix in both digital (red) and offset print

The summary of the fifth annual Global Trends report from drupa shows that confidence is improving in most – but not all – sectors and regions, with packaging leading but commercial also making steady progress since 2013.

The report, which will be published in full later in April, polled over 700 printers and nearly 250 suppliers who visited the 2016 show. While it says that conversion to digital print is slow, particularly in packaging, it also reveals that cut-sheet toner presses are the top 2018 acquisition priority for commercial printers, followed by sheet-fed offset and digital wide format. Across all sectors, finishing equipment is the most popular focus for investment, with press technology and workflow and MIS following. One area of notably slow growth is in web-to-print where only 27% of respondents have an online storefront, a rise of only 2% since 2014.

There is still a squeeze on prices and margins but some evidence that this is lessening gradually, though this varies by region with North America consistently strongest but Europe improving, and by sector; commercial print prices are still continuing to decline but not as badly as in publishing.

Although 42% of printers overall report plans for increased capital expenditure this year versus 9% expecting to spend less, the message is that a considered and strategic approach to investment is important to counter price pressures and competition from digital channels:

Richard Gray, operations director at Printfutures, which carried out the survey in collaboration with Wissler & Partner, commented: ‘Both printers and suppliers clearly understand the strategic challenge that print faces. However, there is increasing confidence in a strong future for printers in most markets and regions, as long as they analyse their target markets carefully and make suitable innovations to meet the future needs of their clients’ customers.’