In this feature, Close Brothers Asset Finance shares the results of their research into the Print and Packaging sector, while also providing more information on what asset finance is and how it works.

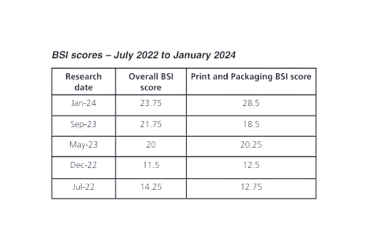

The funders’ Business Sentiment Index (BSI), which measures SME business confidence, has risen modestly for the third consecutive research period, with the Print and Packaging sector maintaining its upward trajectory.

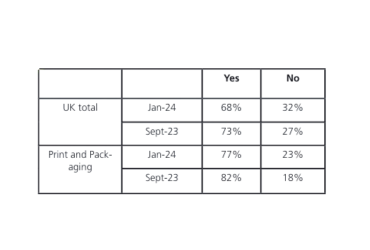

Appetite for investment

Print and Packaging BSI score 28.5 18.5 20.25 12.5 12.75 Print and Packaging firms’ appetite to invest dipped slightly from a high of 82% in September 2023 to 77% in January 2024, but despite the slight dip, it is still among the highest of the sectors we track.

Q: Does your business plan to seek funding for business investment in the next 12 months?

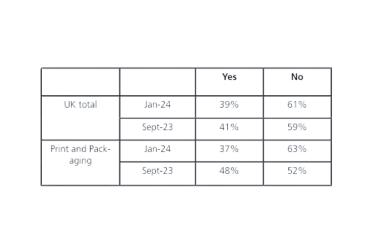

Missed opportunities

The number of companies that have missed business opportunities because of a lack of available funding continued to fall and this latest figure is in line with the more normalised levels achieved for this question, last seen in May 2022.

At 37% (Sept 2023: 48%), the Print sector’s responses are very much in line with that of the UK, as a whole.

Q: Have you missed a business opportunity in the last 12 months, due to lack of available finance?

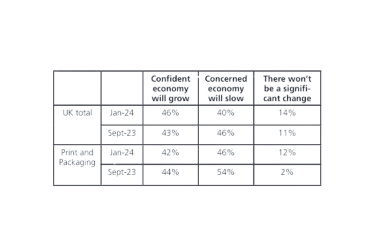

Economic outlook

Confidence in the macroeconomic outlook among SMEs – including those in Print and Packaging – has incrementally improved, achieving positivity for the first time in around two years, but it’s worth remembering that in November 2021, 75% of respondents were positive about the economy – by January 2024 this had reached just 46%, which is itself an improvement.

Q: How would you best describe your business’s economic outlook for the coming 12 months?

Predicted business performance

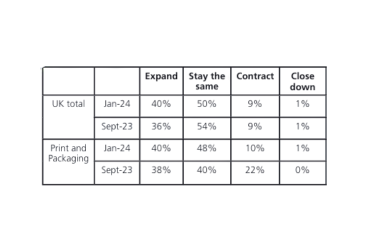

Reflecting the overall BSI result, predictions about future business performance rose slightly. What hasn’t changed is that most firms expect to continue treading water in 2024, with their prospects remaining unchanged.

Q: In general, how do you expect your business to perform over the next 12 months?

Asset Finance – how it works

Asset finance is, for many firms, a form of funding they have used for many years. Yet still, for others, it’s not something they know much about. In this article Close Brothers Asset Finance takes a closer look at the different products and understand why it could be the perfect option when considering your next purchase.

In short, asset finance is an alternative form of funding used by businesses to obtain the equipment they need to grow or access much-needed cash. Asset finance makes the otherwise unaffordable affordable because it gives businesses access to the equipment they need without incurring the cash flow disadvantage of an outright purchase.

Agreements can also be customised to the business’s needs, with flexibility on both the term and repayment schedule.

There are various products that come under the broad umbrella of asset finance with one of the key ones being Refinancing or capital release, as it’s also known; it’s a proven way to make your assets work for you and release cash back into the business.

It works by the finance company purchasing the asset and financing it back to you, with repayments calculated in line with the income the asset is expected to generate; at the end of the refinance term, you own the asset.

This offers several great benefits to a business that just needs a cash injection, whether it’s for investment in additional business critical assets or to use in other areas of the business, including unexpected bills and invoices, salaries, VAT payments, diversification – the uses are almost endless.

Funders can also look to take over a finance agreement with another provider and extend the term, ultimately reducing monthly payments and easing the pressure on cash flow.

Other examples of asset finance products are:

- Hire Purchase (HP) allows you to buy the equipment on credit. The finance company purchases the asset on your behalf and owns the asset until the final instalment is paid, at which point you are given the option to buy it.

- Finance lease: The full value of the equipment is repaid to the finance company, plus interest, over the lease period. At the end of the term, you can choose to:

- continue to use the asset by entering a secondary rental period • sell the asset and keep a portion of the income from the sale

- return it

- Operating lease: Similar to a Finance Lease, an Operating Lease allows you to rent the asset from the asset funder while you need it. The key difference between the two is that an Operating Lease is only for part of the asset’s useful life. This means you pay a reduced rental because the cost is based on the difference between the asset’s original purchase price and its residual value at the end of the agreement.

Paul Philbrick, Managing Director of Close Brothers’ Asset Finance’s Print Division, said: “The recovery in confidence, albeit cautious, among the UK’s small and medium business owners continues, is clearly positive news.

“However, our research reinforces the feedback we’re getting from the stakeholders in our key sectors that the recovery in sentiment very much depends which industry they operate in.

“Our commitment to the SME community is that we will continue to work with firms through the cycle, providing expert advice and building long-term relationships, as we’ve always done.

For more information, please visit: closeassetfinance.co.uk/asset-finance

This article is an advertorial; the featured company created the wording and paid for its placement. It has been checked by Whitmar Publications to ensure that it meets our editorial standards.