The UK’s print and printed packaging industry continued its recovery in Q4 2021 and the outlook on balance for the first quarter of 2022 remains positive, despite mounting concerns overs costs, labour and materials, says the BPIF in its latest Printing Outlook survey.

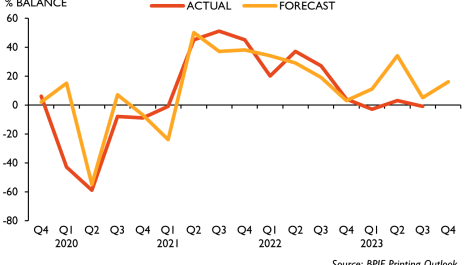

While not as good as in the third quarter of 2021, the Q4 improvement came despite the introduction of ‘PlanB’ measures in response to the arrival of the Omicron variant of Covid-19, with 63% of printers surveyed increasing output level in that quarter, while 19% held steady and the remaining 18% saw a decline. This led to a net balance (positives minus negatives) of +45, above the Q3 2021 forecast of +38, but lower than the Q3 balance of +51. The Plan B restrictions, although arriving late in the quarter, did affect printers serving the events and hospitality sectors, however.

Activity levels are expected to remain positive, but less so, in Q1 2022, with just over half (51%) expecting output growth to continue and just under a third (32%) expecting to hold steady, while 17% expect to see a decline. This yields a net positive balance of +34, which high for this time of year in historical terms, but reflects the continuing recovery from severe disruption.

Top of the factors exerting a drag on further recovery and growth is substrates costs, which is now the top business concern for the third successive quarter, ranked first by 78%, with rising energy costs now in second place at 58%. Competitors pricing below cost is still in the mix at 43%, followed closely by access to skilled labour at 41%. The economic impact of Covid-19 was cited by 29%.

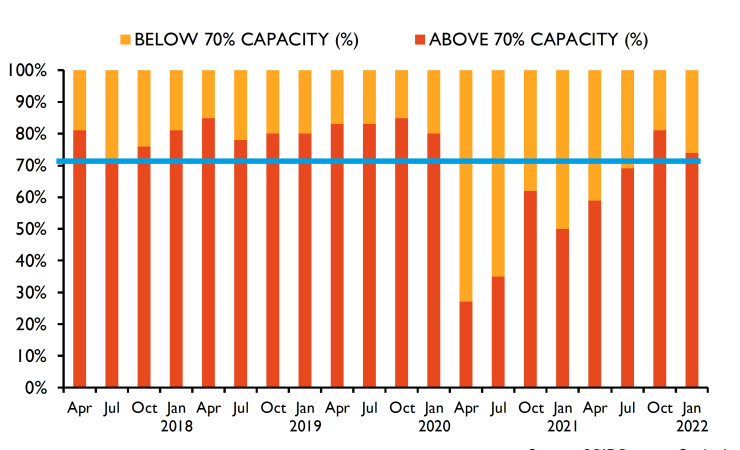

The survey also measured industry capacity utilisation which gives a picture of the impact of the pandemic and other economic factors on the industry. While the two-year picture is encouraging, with only 3% operating at under half capacity in January 2022 compared to 8% a year earlier and more than half in that situation in May 2020, looking at the 70% capacity benchmark, 74% are now at that level or better, compared to 81% in October 2021.

Constraints on capacity were examined too, with the most significant being supply chain issues, with just over half (51%) of the responding companies saying this was limiting output, typically by between 10 and 15%. Other constraints were shortage of both skilled and unskilled labour and machine downtime.

BPIF economist Kyle Jardine commented, ‘The continued recovery of the printing industry is certainly something to be positive about – orders, output and capacity levels are building. Unfortunately, so too are the headwinds that are acting to constrain a faster and fuller recovery – and we are still in recovery.

‘However, the Government survival schemes must get some credit – the financing and credit condition status is currently healthier than might have been feared. Importantly, investment intentions are more positive than for the last two years.’

Charles Jarrold, BPIF chief executive, added, ‘It’s encouraging to have seen the increases in output in quarter four, and a sense of optimism about that continuing into Q1 this year. However, there are some significant challenges, particularly in the availability and cost of supplies, adding to pressure from higher energy prices and increases to National Insurance and the National Minimum Wage. We are combining efforts with our European counterparts to highlight how vital supply chains to food, beverages and pharmaceuticals are being restricted by supply shortages and the risk to these from prolonged strikes at mills overseas, and continue to highlight to UK government the really intense cost pressure on the sector, particularly those arising from policy decisions.’