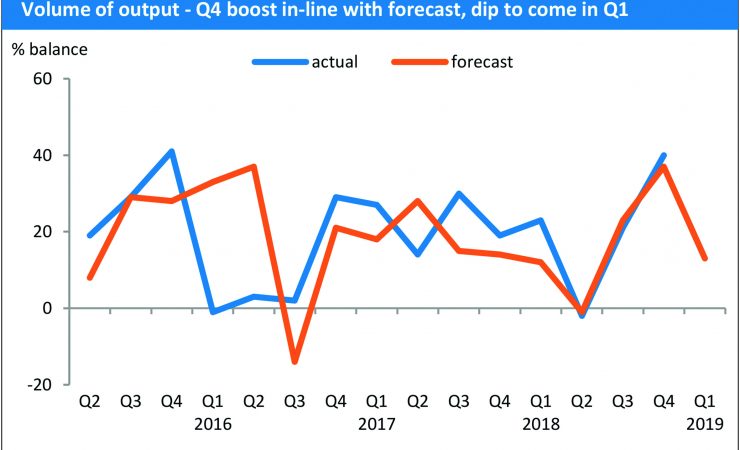

The latest Printing Outlook survey from the BPIF shows a better than expected seasonal boost at the end of 2018 but with lowered, albeit still mostly positive expectations for the first quarter of 2019.

Just over half of printers (53%) reported increased output in the fourth quarter of 2018, while around a third (34%) held steady and 13% declined, representing the strongest seasonal boost for three years, though not reaching the levels last seen before the 2008 financial crisis. This comes despite respondents commenting on ‘turmoil, uncertainty and unpredictability’, and even those who have experienced growth feeling that they are ‘bucking the trend’.

Looking ahead, fewer expect their activity to increase in the first quarter of 2019, though the overall balance is still positive, with just over a third (34%) saying they forecast growth, 45% expecting steady output levels but an increase to 21% of those who anticipate a fall in activity.

The top concern is is once again competitors pricing below cost, cited by 60% of respondents, but with Brexit now a close second at 58%, up from 44% in the previous quarter, reflecting the approaching EU exit deadline and gridlock in parliament increasing the prospect of a ‘no-deal’ departure. The third most popular concern was rising paper prices, voiced by 53%.

Despite these issues and an uncertain economic outlook, investment intentions for plant and machinery have picked up, as have training and retraining plans. Almost half (47%) anticipate higher levels of investment in 2019, while 30% expect to maintain levels of spend and only 14% expect to reduce it. The balance level is above that recorded for the previous two years.

Getting paid for the work isn’t getting easier, though. Being forced to accept increasing payment terms is also a significant issue for almost half (48%) of respondents with a majority of these (64%) having to move to 90 days and nearly a quarter 120 days or more.